The Future of Spending: Why Much More Individuals are Selecting Gold IRAs for Their Retirement

Introduction

In an ever-evolving economic landscape, where market volatility and financial unpredictability preponderate, investors are on the lookout for stable choices that can supply long-term security. One alternative that’s getting significant traction is the Gold Individual Retired Life Account (INDIVIDUAL RETIREMENT ACCOUNT). As even more people consider their retired life techniques, it appears that gold IRAs provide an unique mix of protection versus rising cost of living, diversity benefits, and capacity for development. This post delves deep right into the reasons the future of spending appears to be leaning toward gold IRAs as individuals aim to safeguard their retired life savings.

The Future of Spending: Why Much More Individuals are Choosing Gold IRAs for Their Retirement

Gold has been an icon of riches and stability for countless years. In current times, however, its function in financial investment profiles has progressed right into an important asset course that financiers are transforming to more than ever before. With the increase in stock market changes and unforeseeable financial conditions, gold IRAs have actually emerged as a safety action against monetary downturns.

What is a Gold IRA?

A Gold individual retirement account is a self-directed private retired life account that permits you to purchase physical precious metals like gold, silver, platinum, and palladium. Unlike conventional IRAs that limit you to stocks and bonds, gold IRAs open a whole brand-new perspective of financial investment chances. Here’s what sets them apart:

- Physical Ownership: You possess substantial possessions instead of paper assets.

- Tax Advantages: Like conventional Individual retirement accounts, gold IRAs likewise benefit from tax-deferred growth.

- Diversification: They supply an excellent method to diversify your portfolio.

Why Take into consideration a Gold IRA Rollover?

If you’re contemplating transferring your existing retirement cost savings right into a gold individual retirement account, after that you may want to think about a gold IRA rollover This process enables you to move funds from your existing 401(k) or other pension right into a brand-new gold IRA without encountering prompt tax obligation penalties.

Benefits of Gold IRA Rollovers

How Does a 401(k) to Gold Individual Retirement Account Rollover Work?

Understanding how a 401(k) to gold IRA rollover functions is crucial prior to making any choices. Here’s how it usually unravels:

401(k) to Gold Individual Retirement Account Rollover Without Penalty

Many people bother with incurring charges during this process. The good news is, if carried out appropriately through straight transfers in between custodians, you can attain this shift without sustaining any kind of penalties or taxes.

Why Is Currently the moment for Gold IRAs?

Given today’s economic climate characterized by inflationary stress and geopolitical tensions, several financiers see gold as a safe house asset– a hedge versus financial instability.

Inflation Hedge

Gold has actually traditionally preserved its worth during periods of inflation unlike currency-based investments which can deteriorate with time due to boosted prices.

Geopolitical Stability

In unsure times– be it political discontent or global pandemics– gold frequently keeps its well worth while other possessions may falter.

The Duty of Diversity in Retired Life Planning

Retirement planning isn’t just about collecting wide range; it’s likewise regarding ensuring that wide range stays intact throughout one’s retirement years.

What Is Diversification?

Diversification involves spreading investments across different possession courses how gold ira rollover works (supplies, bonds, assets) to reduce danger exposure.

How Does Gold Fit In?

Gold serves as an effective diversifier since it frequently behaves in different ways than conventional equity markets– when stocks decrease throughout chaos or recessions; gold often tends to hold consistent or even value in value.

Investing Methods with Gold IRAs

To make best use of returns from your precious metal investments within an IRA framework calls for tactical planning:

The Process of Establishing Your Own Gold IRA

Setting up your own gold IRA doesn’t need to be overwhelming if you comply with specific steps:

Types of Precious Metals Qualified for Financial Investment in Gold IRAs

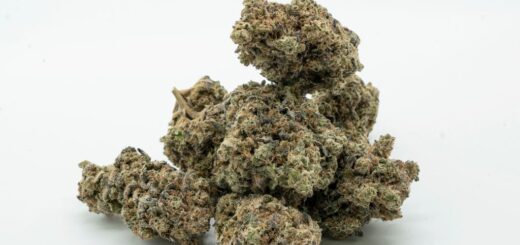

Not all forms of gold are eligible for incorporation in an IRA account; below’s what you require:

- Gold bullion: Should meet pureness standards (typically.9999 fine).

- Gold coins: Authorized coins consist of American Eagles and Canadian Maple Leafs amongst others.

- Other Valuable Metals: Silver (.999 ), platinum (.9995 ), and palladium (.9995) are additionally viable options.

How Much Ought to You Buy a Gold IRA?

Determining just how much cash should be designated in the direction of your gold investment eventually depends on individual situations consisting of:

- Current retirement savings

- Risk tolerance

- Overall investment method

Many specialists suggest allocating between 5% – 10% relying on personal monetary goals while being mindful not to over-concentrate in any solitary property class.

Common False impressions Regarding Gold IRAs

With anything new comes suspicion; below are some myths bordering gold IRAs disproved:

- Reality: Custodians handle storage firmly under rigorous regulations.

- Reality: Historically talking– particularly throughout slumps– gold has commonly outmatched other possessions over time.

- Reality: Any individual can begin small; there are options available despite starting capital!

The Threats Associated with Purchasing Gold IRAs

While there are numerous advantages connected with investing in rare-earth elements with an IRA framework– it’s prudent not ignore prospective threats included:

- Market Volatility

- Storage Costs

- Regulatory Changes

Being conscious aids decrease prospective risks while making best use of gains from such investments!

Frequently Asked Concerns About Gold IRAs (FAQs)

1. What is the minimal investment needed for a Gold IRA?

Most custodians require at least $5,000– $10,000 at first yet this differs significantly based on specific companies’ policies!

2. Can I keep my very own physical gold?

No! Laws stipulate that all physical possessions have to be kept via approved third-party depositories for conformity purposes.

3. Exactly how do I know which custodian is appropriate for me?

Look into testimonials & & ratings online; ask about charges & & services they supply related particularly in the direction of taking care of precious metals within an IRA structure!

4. Can I withdraw my precious metals before retired life age?

Yes– yet doing so might trigger fines unless certain requirements established by IRS standards are satisfied under specific circumstances!

5. Is there any kind of penalty included when rolling over my existing accounts?

If done effectively using direct transfers in between custodians– there should not be any kind of fines incurred during this process at all!

6. What happens if I transform my mind after opening up my account?

You have actually moratorium given by a lot of custodians enabling reconsideration post-signature however constantly verify prior details by means of agreement agreements beforehand!

Conclusion

The future looks intense for those considering their alternatives within investing realms– especially concerning varied methods like gold Individual retirement accounts! With numerous benefits varying from tax advantages & & rising cost of living hedging with solid diversity techniques– it’s no wonder why much more people seek these choices today compared versus traditional techniques alone!

By understanding how best technique transitioning existing accounts towards offering higher safety & & development leads ahead– it becomes clear why numerous choose this route moving forward!